Tax rate in box 3 is 31 (before 2021 it was 30).

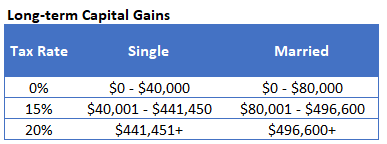

An additional 3.8 bump applies to filers with higher. The actual level of return (for example interest, dividend, capital gains or losses) is not relevant. Because you owned the car for only six months, it is a short-term capital gain. Tax brackets for long-term capital gains (investments held for more than one year) are 15 and 20. Below, well look at the tax brackets that.

#Capital gains tax brackets 2020 plus#

That leads to tax of 987.50 plus 15, or 1,002.50 in total.

If you buy a collectible car for $10,000 in March and sell it for $15,000 in September, you have a capital gain of $5,000. But you only pay 12 taxes on the income from 9,875 to 10,000, or 125 of income. You earned a 20,000 capital gain on shares you own for more than 12. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. What are the 2021 long-term capital gains rates and how do they compare with 2020 The charts. Your salary is 150,000 per year with income tax bracket of 37 (90,001 180,000). An individuals net capital gains are taxed at the rate of 7. You’ll pay 10% if you’re a sole trader or partnership and your gains qualify for Business Asset Disposal Relief.The ordinary tax rates for 2022 taxable income filed in 2023 are listed below. Long-term capital gains are taxed at either 0, 15, or 20 depending on your tax bracket. Trustees or personal representatives of someone who’s died pay: It should also be noted that taxpayers whose adjusted gross income is in excess of 200,000 (single filers or. You can use your tax-free allowance against the gains that would be charged at the highest rates (for example where you would pay 28% tax). Long Term Capital Gains Tax Brackets (for 2023).

If you have gains from both residential property and other assets Child Tax Credit The child tax credit totals at 2,000 per qualifying child and is not adjusted for inflation. All these are relatively small increases from 2019. You can see the tax-free allowances for previous years. The maximum credit is 3,584 for one child, 5,920 for two children, and 6,660 for three or more children. This means you’ll pay £660 in Capital Gains Tax. Income Tax Rates - The 2020 tax brackets are the same as the rates in effect for the 2019 tax year: 10, 12, 22, 24, 32, 35 and 37. Because the combined amount of £26,600 is less than £37,700 (the basic rate band for the 2023 to 2024 tax year), you pay Capital Gains Tax at 10%. Based on filing status and taxable income, long-term capital gains for tax year 2023 will be taxed at 0, 15 and 20. For the 2023 to 2024 tax year the allowance is £6,000, which leaves £6,600 to pay tax on.Īdd this to your taxable income. CGT is on gains arising from sale of property. Your gains are not from residential property.įirst, deduct the Capital Gains tax-free allowance from your taxable gain. the Capital Gain is not subject to further taxation after payment of the 15 rate of tax. Your taxable income (your income minus your Personal Allowance and any Income Tax reliefs) is £20,000 and your taxable gains are £12,600.

0 kommentar(er)

0 kommentar(er)